per capita tax in pa

If you pay your bill on or before the discount date in September you receive a 2 discount. Municipalities and school districts were given the right to collect a 1000 per capita tax under ACT 511 and School Districts an additional 500.

Online Bill Pay Options Paying Bills Bills Self

It is not dependent upon employment.

. Enter your Control Number and Web Password then click on Submit and follow the instructions. Kensinger 909 North Second Street Bellwood PA 16617 Phone. The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions.

The amount of revenues estimated to be derived from these taxes are as follows. A combined per capita tax is billed on August 1 of each year. However proof must be provided yearly.

Earned Income Tax Realty Transfer Tax and Per Capita Tax for the fiscal year of 2022. Keystone Collections is the tax collector for this tax. Local Services Tax 3500000 2.

Control Number 8 Numbers Web Password 8 Letters 3. Occupation Assessment taxes Issued to any person who is working this tax is based on an individuals job title. Enter your invoice number located directly above your name on the payment voucher you received with your bill and select an available payment option.

The tax is distributed 5 to Hempfield Township and 10 to the Hempfield Area School District. Tax Day is Monday April 18 2022. You must file exemption application each year you receive a tax bill.

This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Is this tax withheld by my employer. City Per Capita Taxes are based on a calendar year from January 1 thru December 31 of the current year.

413 N Warren St Orwigsburg Pa. Lebanon County Real Estate Tax. The school district as well as the township or borough in which you reside may levy a per capita tax.

Keystone offices will be closed on Friday April 15 in observance of Good Friday. Earned Income Tax 55700000 3. A proportional tax levied on the.

What is the Per Capita Tax. 10010 A per capita tax of 1000 or a legal amount as set by resolution of Council for general Borough purposes is hereby levied and assessed under the authority of the Act of December 31 1965 PL. Per PersonPer Capita taxes Issued to any person age 18 or older who resides in the Phoenixville Area School District.

1500 if paid in October or November. College students with proof of full-time status are exempt. Steelton Borough Steelton-Highspire School District Paint Borough Delinquent Per Capita only Scalp Level Borough Delinquent Per Capita only Windber Borough delinquent Per Capita only and Shanksville-Stonycreek School District.

Beginning in 2020 these two taxes will be included on one bill which will be mailed to each. This tax does not matter if you own rent or have a child attending the Phoenixville Area School District. Per Capita Tax OR2-1978 10000 Tax Rate.

The municipal tax is 500 and the school tax is 1000 These taxes are due on an annual basis. Any type of charge back will be assessed a 45 charge back fee. 1575 if paid after November 30th.

Antis Township Elected Tax Collector Susan E. A flat rate tax levied on each adult resident within the taxing district. Per capita tax for Unity Twp.

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. 1470 if paid in August or September. Elected Tax Collector - Missy King 10 Eleanor Drive Spring City PA 19475 Phone.

Is five dollars per individual while per capita tax for Greater Latrobe School District is ten dollars per individual. Per Capita taxes are assessed by the Municipality and the Franklin Regional School District on all residents who have attained the age of twenty-one 21. Per Capita Tax 920000.

Elco School District Per Capita Tax. Per Capita Exoneration Change of Address for Tax Billing. Exoneration from tax is applicable to the current tax year only.

A flat rate andor proportional tax levied on the occupation of persons residing within the taxing district. Click VIEWPAY TAXES to access the MyProperty Login Screen 4. For real estate taxes it is 400 or 35 whichever is higher for each property.

Access Keystones e-Pay to get started. Real Estate Transfer Tax. 610-495-7667 Collects Township Real Estate Per Capita Tax Tax Certifications may be obtained by submitting a request and payment of 10 per parcel to Missy King at the address above.

Realty Transfer Tax 4000000 4. 1256 known as the Local Tax Enabling Act and. Per Capita Personal Income in Schuylkill County PA PCPI42107 2020.

Locate your County Tax Bill or other County notice. Per Capita taxes not paid by December 31 will be submitted to Berkheimer Associates for collection. NOTICE - The tax office is closed for in-person payments.

Per Capita Payment Schedule. Per Capita tax is a flat tax of 15 per person over the age of eighteen 18. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

On that document look for the following information. Mornings 1000 am to Noon Thursday. Taxpayer Services phone hours are extended on Thursday April 14 and Monday April 18 from 8 AM 7 PM ET.

Per Capita means by head so this tax is commonly called a head tax. For per capita it is a flat rate of 200. Per capita exemption requests can be submitted online.

Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction. If you pay after the Face Amount due date in November a 5 penalty is added to your taxes until the end of the year. Do I pay this tax if I rent.

Elco School District Real Estate Tax 2020-2021. Normally the Per Capita tax is NOT. Evenings 700 pm to 900 pm Saturday.

47425 Dollars Annual Updated.

State Local Property Tax Collections Per Capita Tax Foundation

Portugal Household Income Per Capita 1995 2022 Ceic Data

Apac Gni Per Capita By Country Statista

Craft Beer Breweries Per Capita In The U S By State 2020 Statista

Key Aspects Of Per Capita Personal Income

States That Offer The Biggest Tax Relief For Retirees Best Places To Retire Retirement Locations Retirement Strategies

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Switzerland Household Income Per Capita 2006 2022 Ceic Data

Information About Per Capita Taxes York Adams Tax Bureau

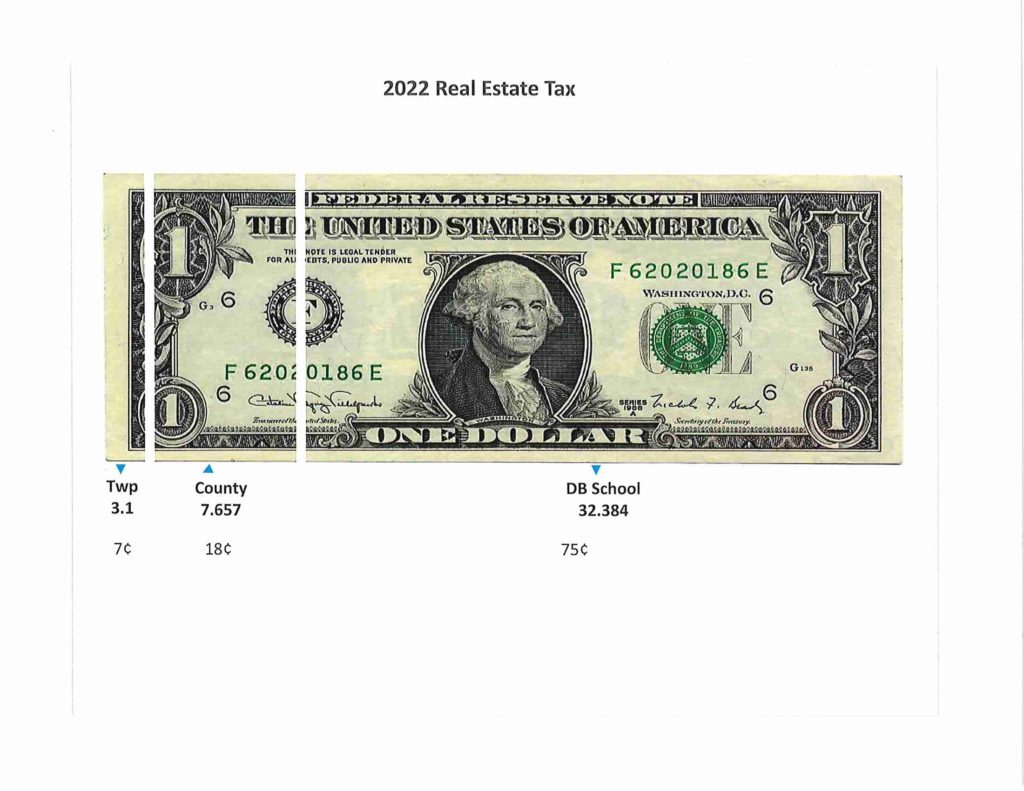

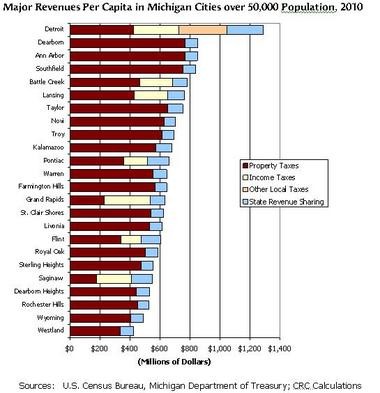

Analysis Detroit Enjoys Highest Per Capita Revenue In State Thanks To High Diversified Tax Rates Mlive Com

Real Estate And Per Capita Tax Wilson School District Berks County Pa

Maptitude Mapping Software Map Infographic Of Turkeys Raised By State Map Mapping Software Infographic